Articles

Although not, up to ten casinos have seen the benefit of enabling someone is actually aside what they are offering ahead of asking for the customer’s money. While the professionals, we are able to take full advantage of one to from the merging several no deposit bonuses away from several gambling enterprises. For each program have certain requirements which make it just about popular with certain taxpayers. Specific home advancements don’t qualify for incentive decline however, perform high quality to possess Area 179 procedures.

- So it restriction is quicker by the count where the purchase price out of area 179 assets listed in services in the income tax year is higher than dos,890,100000.

- During the a top after-income tax prices, fewer money potential is actually practical.

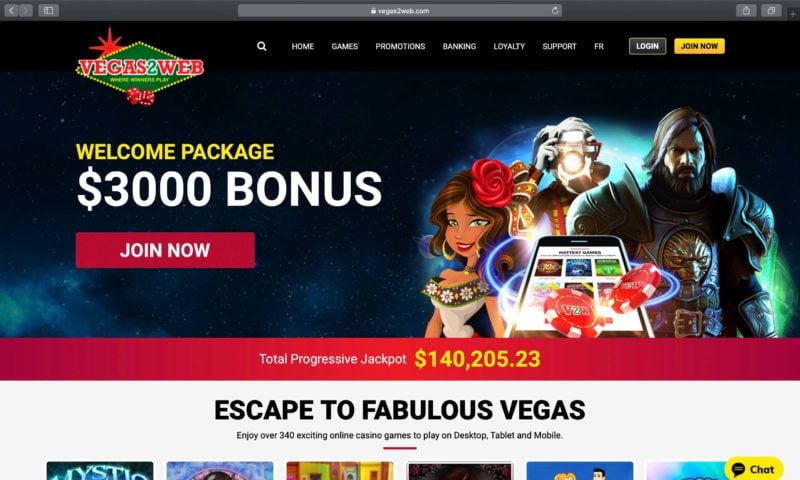

- Revealed in the 2013, the newest gambling enterprise has created by itself historically since the a respected label inside the community.

- Itemized write-offs is actually common one of high-money taxpayers whom normally have significant deductible expenditures, for example condition and you will local taxes paid, home loan attention, and you can charitable contributions.

- Companies and you can, to help you a lesser the amount, anyone, build financial behavior inside the white from how they may greatest maximize its income.

You should check the newest fee reputation for your bank account on the cashier to see if your detachment has been processed. Champ takes all the and you may common jackpots honor several thousand dollars all the go out entirely in order to Lion’s Display players. A much better-tailored taxation system will be a goal of people financial combination package. However, all of our simulations suggest that actually significantly high taxation increases is shortage of so you can curtail long-work at loans-to-GDP gains. Defeat is intended to address a legitimate problem, and there are virtues to beat’s overall strategic method; yet not, the execution renders place for update.

Economic, Money, And Distributional Feeling Away from Permanent 100 percent Extra Decline | fruitful link

Notably, complete and immediate expensing makes it possible for greatest taxation out of investment money fruitful link . The new decline method is preferred because of the accounting profession and monetary revealing objectives so you can shareholders. However, this process cannot sound right to have tax formula intentions.

What is the Legal Gaming Years To use Betmgm Gambling establishment?

To own property listed in services after September ten, 2001, only the depreciation deduction welcome lower than IRC §168 essentially to the December 29, 2001 — personal of any amendments made after one to time — are greeting.LAYes. Studies have shown past instances of extra decline features boosted investment buildup and you may a job, especially one of disadvantaged experts. All of our modeling suggests and then make completely extra depreciation a long-term function of the U.S. taxation code manage raise enough time-work at economic output by the 0.cuatro percent, the capital stock from the 0.7 per cent, and you can a career by the 73,100000 full-day comparable work.

Every piece of information on this web site is for instructional objectives only, and you will paying deal dangers. Usually do your research ahead of using, and get ready to accept potential losings. FTX was aggressively selling out of its assets to improve the new finance must pay back financial institutions. Specific loan providers, dependent on its claim kind of, may see an income all the way to 142percent – meaning they get back more than it in the first place missing.

User Type

Simultaneously, the fresh requirements constraints how asset is received otherwise the way the basis is usually to be computed. If you have expiring charity deduction carryforwards otherwise credit carryforwards, you could decide to decide away. While the charity deduction carryforward or other credit is limited by your nonexempt income, you can also decide never to allege incentive decline to keep your latest income sufficient for taking complete benefit of any carryforwards or loans which may be expiring. Nj decoupled from government depreciation by July 2002, and so the condition cannot adhere to the new Tax Incisions and Perform Operate provision you to definitely stretches incentive depreciation for accredited possessions acquired and you may placed in service away from 2015 thanks to 2019. Otherwise thanks to 2020 for sure lengthened-existed and you can transport features.NMYes. Claims realize other ways within the following compliance to the IRC, leading to inconsistent county tax remedy for federal expensing and you can added bonus decline laws and regulations.

What’s the Betmgm Gambling establishment Extra Code?

An election out would require taxpayers to ease a modification of the new data recovery months and you may strategy since the a change in fool around with . By using a great 100percent extra decline deduction, you remove the chance to depreciate a valuable asset more than its helpful existence. Growing enterprises with reduced net income might want to help you dispersed the expense of the property over the useful lifetime.

Kommentare von reda